PCB BANCORP (PCB)·Q4 2025 Earnings Summary

PCB Bancorp Delivers 31% YoY Earnings Growth, Raises Dividend 10%

January 29, 2026 · by Fintool AI Agent

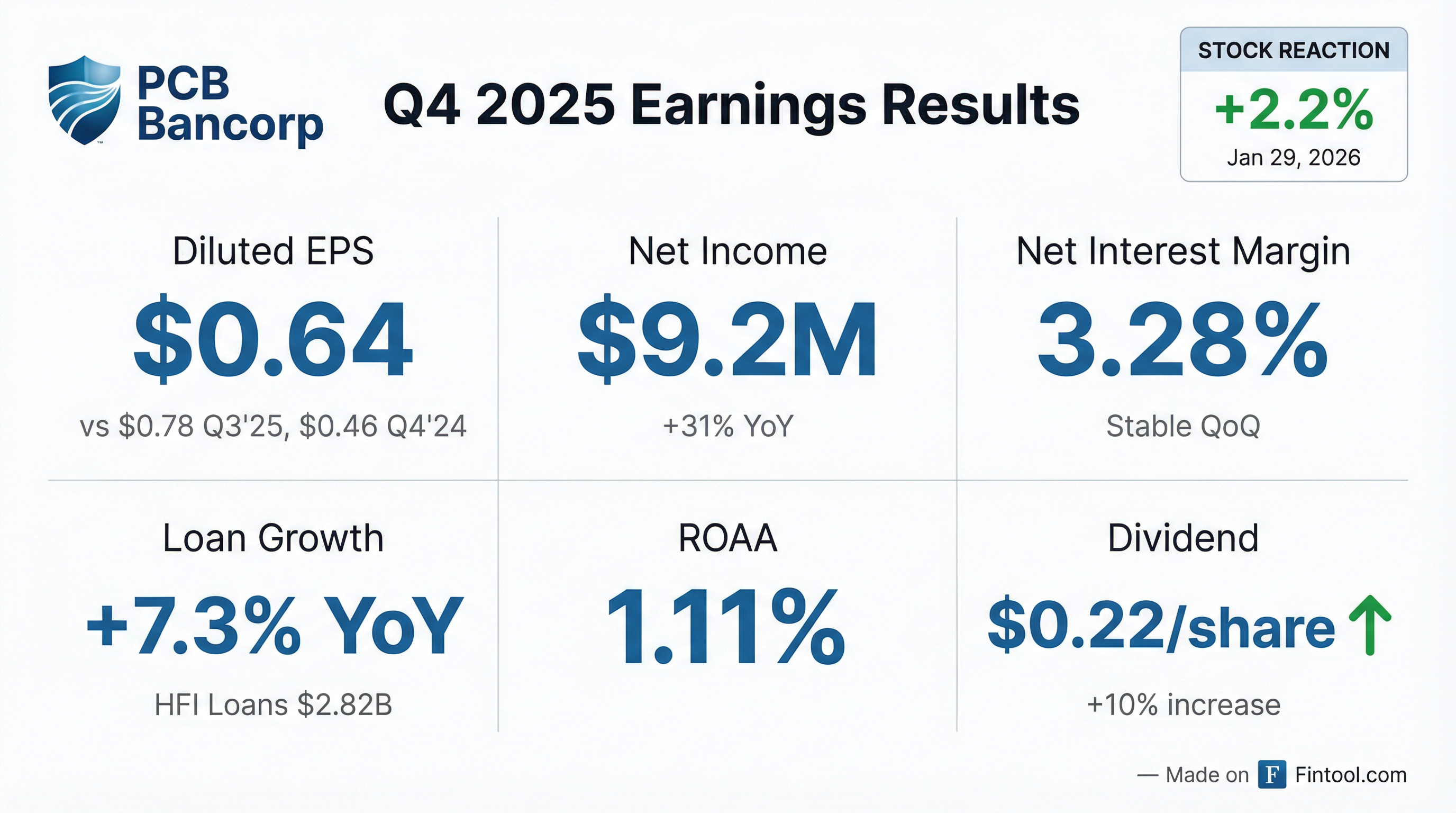

PCB Bancorp (NASDAQ: PCB), the holding company for PCB Bank serving Korean-American and minority communities in Southern California, reported Q4 2025 diluted EPS of $0.64, up 39% year-over-year from $0.46. The company also announced a 10% dividend increase to $0.22 per share, signaling confidence in its earnings trajectory.

Did PCB Bancorp Beat Earnings?

Yes, on a YoY basis. PCB delivered strong year-over-year growth, though results declined sequentially from an exceptional Q3:

The sequential decline was primarily due to:

- Lower gain on sale of loans: $648K vs $1.6M in Q3 (SBA loan sales volume dropped 54%)

- Higher provision for credit losses: $1.0M vs reversal of $(381K) in Q3

- Lower noninterest income: $2.5M vs $3.4M in Q3

Full Year 2025 was exceptional: Net income of $37.5M (+45% YoY) and diluted EPS of $2.58 (+48% YoY).

What Did Management Guide?

CEO Henry Kim provided qualitative guidance but no specific numbers:

"Heading into 2026, even with the backdrop of ongoing geopolitical tensions and domestic conflicts, our loan pipeline remains strong."

Key forward-looking comments:

- Loan demand remains robust with $158.8M quarterly production in Q4 vs $136.7M in Q3

- Management intentionally did not compete with elevated marketplace deposit rates

- NIM maintained at 3.28% despite rate cuts impacting variable loan yields

How Did the Stock React?

PCB rose 2.2% on earnings day, closing at $22.02.

The stock has traded in a $16.00-$24.04 range over the past 52 weeks. At current levels:

- Market cap: ~$314M

- P/E (trailing): ~8.5x (based on FY2025 EPS of $2.58)

- Price/Book: 0.80x ($22.02 vs book value of $27.41)

- Dividend yield: 4.0%

The positive reaction reflects:

- 10% dividend increase to $0.22/share

- Solid credit quality (NPLs at 0.28% of loans)

- Strong capital position (Tier 1 leverage 11.89%)

What Changed From Last Quarter?

Balance Sheet Shifts

Deposit dynamics: Total deposits declined $118M as management let $100M in brokered deposits run off and chose not to match aggressive competitor rates. Retail deposits declined just $18M.

Credit Quality Stable

NPLs remain well-covered at 4.2x by the allowance for credit losses.

Segment Breakdown: Loan Portfolio

PCB's $2.82B loan portfolio is heavily weighted to commercial real estate in California:

CRE concentration: 308% of total risk-based capital — above the 300% regulatory guidance threshold but consistent with the Korean-American community banking model.

Geographic mix: 79% of CRE loans in California (61% Los Angeles County), with NY/NJ (7%) and Texas (6%) as secondary markets.

Capital Allocation

PCB continues to return capital aggressively while maintaining strong ratios:

Dividend: Raised 10% to $0.22/share quarterly ($0.88 annualized). Payout ratio of 32% based on 2025 EPS.

Buybacks: Repurchased 358,251 shares in 2025 at $19.82 average ($7.1M total). 219,526 shares remain authorized through July 2026.

Capital ratios remain well above minimums:

Liquidity Position

PCB maintains substantial liquidity headroom:

- Cash and equivalents: $207M (6.3% of assets)

- Available borrowing capacity: $1.75B (53% of assets)

- FHLB: $841M

- Fed Discount Window: $842M

- Overnight federal funds: $65M

Uninsured deposits of $1.27B (45% of total) are well covered by available liquidity sources.

Key Risks and Concerns

-

CRE concentration at 308% of capital remains elevated, though PCB has historically managed this well

-

Deposit competition: Management intentionally let deposits decline rather than match aggressive competitor rates — sustainable near-term but may pressure NIM if loan growth continues

-

Sequential earnings decline: Q4 was a step down from Q3's exceptional results; investors should focus on the YoY trajectory

-

Geographic concentration: Heavy reliance on Southern California economy and Korean-American business community

The Bottom Line

PCB Bancorp delivered a solid Q4 capping an exceptional FY2025. While sequential results declined from a strong Q3, the year-over-year story is compelling: EPS up 39%, full-year earnings up 45%, and a 10% dividend raise. Trading at 0.80x book value with a 4% yield, PCB offers a value-oriented way to play the Korean-American community banking niche — provided you're comfortable with the CRE concentration.

Related Links: